21 Nov Debt-Free in No Time: The Ultimate Showdown Between the Snowball and Avalanche Methods

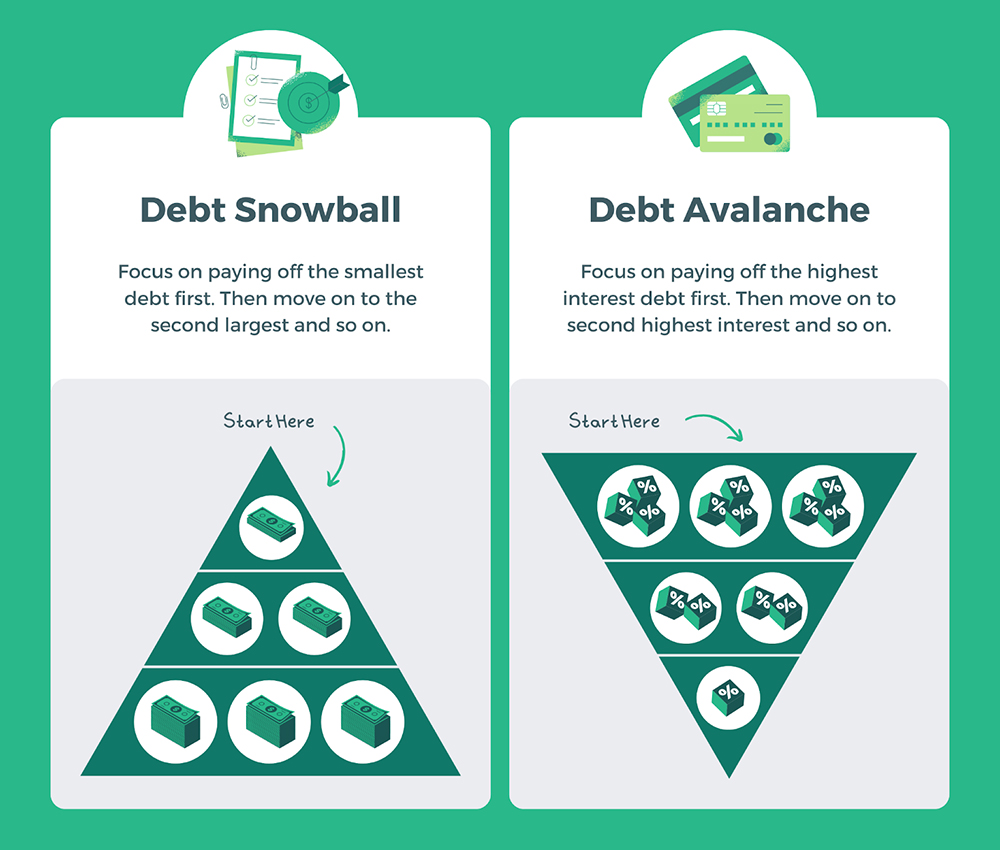

Debt can feel overwhelming, but with the right strategy—and the right support—it becomes manageable. At Level Coaching, we specialize in helping you break free from debt and achieve financial independence. Two of the most effective strategies we recommend to our clients are the Snowball Method and the Avalanche Method. Each has its unique benefits and challenges, and the best choice depends on your financial situation and what motivates you. In this article, we’ll break down these two debt repayment methods to help you decide which one works best for you.

What Is the Avalanche Method?

The Avalanche Method prioritizes tackling debts with the highest interest rates first. With this strategy, you continue to make minimum payments on all your debts but allocate any extra funds toward the account with the highest interest rate. Once that debt is fully paid off, you redirect the extra payments to the next highest-interest debt, and so on.

At Level Coaching, we often recommend this method to clients looking to reduce their overall debt cost quickly, especially those with high-interest credit cards or loans.

Pros of the Avalanche Method:

- Saves Money Over Time

By focusing on high-interest debts, you reduce the total amount of interest you’ll pay across all accounts. This approach can save thousands of dollars over time. - Quicker Progress on Large Balances

High-interest accounts, like credit cards, can balloon over time. Tackling them first prevents interest from compounding and accelerates progress on large debts. - Mathematically Efficient

The Avalanche Method is the most cost-effective option because it minimizes the total amount you’ll pay on your debt. If you’re motivated by financial logic, this method might be your best fit.

Cons of the Avalanche Method:

- Delayed Psychological Wins

Since high-interest debts often have large balances, it may take a long time to fully pay off your first account. This delay can feel discouraging if you’re someone who thrives on quick progress. - Requires Discipline

Without visible early wins, sticking to the Avalanche Method requires a high level of commitment and patience—something Level Coaching can help you stay focused on through accountability and support.

What Is the Snowball Method?

The Snowball Method, popularized by financial coach Dave Ramsey, focuses on paying off debts by balance size, from the smallest to the largest. With this method, you make minimum payments on all accounts but dedicate any extra funds to the debt with the smallest balance. Once the smallest debt is paid off, you move to the next smallest balance, building momentum like a snowball rolling downhill.

At Level Coaching, we often recommend the Snowball Method to clients who need help staying motivated and organized while tackling their debt.

Pros of the Snowball Method:

- Quick Wins Build Momentum

Paying off small debts first gives you immediate victories, which can boost your confidence and motivation. These psychological wins are powerful and can keep you committed to the process. - Simplifies Finances

With each debt paid off, you have one fewer account to manage. This simplification makes it easier to track your progress and stay organized. - Improves Credit Health

As you pay off smaller balances, you free up credit limits, which can improve your credit utilization ratio—a key factor in boosting your credit score. - Encourages Positive Habits

The Snowball Method emphasizes building good financial habits, such as creating a budget, staying consistent, and celebrating milestones. Level Coaching reinforces these habits by working with you to craft a plan that fits your lifestyle.

Cons of the Snowball Method:

- More Expensive Long-Term

Since the Snowball Method doesn’t focus on interest rates, you may end up paying more in interest over time compared to the Avalanche Method. - Less Cost-Efficient

From a purely financial standpoint, this method doesn’t minimize interest payments as efficiently as the Avalanche Method. However, for many of our clients at Level Coaching, the emotional wins outweigh the extra cost.

How Level Coaching Helps You Decide

At Level Coaching, we understand that no two financial situations are the same. That’s why we take a personalized approach to help you choose the debt repayment strategy that works best for your needs, goals, and mindset.

- For Logical Thinkers: If you’re focused on saving money and minimizing costs, the Avalanche Method may be your best option. We’ll help you identify the accounts with the highest interest rates and develop a plan to knock them out quickly and efficiently.

- For Motivation Seekers: If you’re someone who needs quick wins to stay motivated, the Snowball Method could be the perfect fit. We’ll help you organize your debts, track your progress, and celebrate each milestone along the way.

Which Method Is Right for You?

The decision between the Snowball and Avalanche Methods comes down to what motivates you most. Are you driven by the satisfaction of seeing progress quickly? Or are you focused on minimizing the total cost of your debt?

At Level Coaching, we’ll guide you every step of the way. Whether you prefer the emotional gratification of the Snowball Method or the financial efficiency of the Avalanche Method, we’ll create a customized debt repayment plan tailored to your needs. With the right strategy, you’ll not only pay off your debt but also build a strong foundation for a debt-free and financially independent future.

Ready to get started? Let’s work together to break the chains of debt and achieve your goals. Call us today!