19 Dec Unlocking the Benefits of a TFRA: Your Guide to a Tax-Free Retirement Account

When it comes to planning for retirement, most people focus on traditional options like 401(k)s or IRAs. But what if there was a way to grow your wealth, access your funds when you need them, and enjoy tax-free benefits along the way? Enter the Tax-Free Retirement Account (TFRA)—a flexible, powerful tool that goes beyond standard retirement savings. Whether you’re preparing for life’s big milestones or securing your financial future, a TFRA could be the game-changer you’ve been looking for.

Here’s everything you need to know about TFRAs and the incredible benefits they can bring to your financial strategy.

What Is a TFRA?

A Tax-Free Retirement Account (TFRA) is a type of savings vehicle that allows you to grow your money tax-free and access it for more than just retirement. Unlike traditional retirement accounts, TFRAs are typically funded with after-tax dollars, meaning your contributions won’t reduce your taxable income now—but they come with significant benefits down the road.

Think of a TFRA as more than just a retirement account. It’s a financial safety net that can provide:

- Tax-Free Growth

- Tax-Free Withdrawals

- Flexibility to Use Funds for Major Life Expenses

- Protection for Your Loved Ones

TFRAs are often set up as permanent life insurance policies (such as Indexed Universal Life or Whole Life insurance), giving them additional perks like illness payouts and death benefits.

Key Benefits of a TFRA

1. Tax-Free Growth and Withdrawals

One of the most attractive features of a TFRA is its tax-free growth potential. Unlike taxable investment accounts, the money you contribute to a TFRA grows without being subject to taxes on gains. When it’s time to withdraw funds, you can access them tax-free—a major advantage over 401(k)s or traditional IRAs, which are taxed as income upon withdrawal.

💡 Example: Let’s say you invest $50,000 into a TFRA, and over time, it grows to $100,000. When you withdraw that money, you can keep the full $100,000 without worrying about taxes.

2. Illness Payouts and Death Benefits

Unlike most retirement accounts, a TFRA often comes with additional benefits through its life insurance component. These include:

- Illness Payouts: If you face a chronic, critical, or terminal illness, you may be able to access a portion of your account’s value early, giving you financial support during difficult times.

- Death Benefits: In the event of your passing, your loved ones receive a tax-free death benefit, providing peace of mind and financial security for your family.

These features make a TFRA not just a retirement tool, but also a comprehensive part of your financial safety net.

3. Flexibility to Withdraw for Big Life Events

Unlike traditional retirement accounts, which penalize early withdrawals, TFRAs allow you to access funds penalty-free for major life expenses. Whether you’re buying a home, planning a wedding, or need a new car, a TFRA gives you the flexibility to withdraw funds when life calls for it.

Here are some common ways people use their TFRA funds:

- Down Payments on a House: Use your TFRA to help secure your dream home without worrying about taxes or penalties.

- Wedding Expenses: Pay for your big day with funds from your TFRA, making it a smart financial tool for life’s happiest moments.

- Buying a Car: Withdraw money tax-free for a vehicle purchase without dipping into other savings.

This flexibility makes a TFRA a go-to option for those who want retirement savings that can also support them before their golden years.

4. Supplement Your Retirement Income

A TFRA isn’t just about covering life’s milestones—it’s also a powerful way to supplement your retirement income. Because withdrawals are tax-free, you can use a TFRA to create an additional income stream that won’t increase your tax liability. This is especially useful for retirees looking to avoid high tax brackets in retirement.

💡 Pro Tip: Combine a TFRA with other tax-advantaged accounts like Roth IRAs or HSAs for a diversified retirement income strategy. This ensures you have multiple streams of tax-efficient income during retirement.

How Does a TFRA Compare to Other Retirement Accounts?

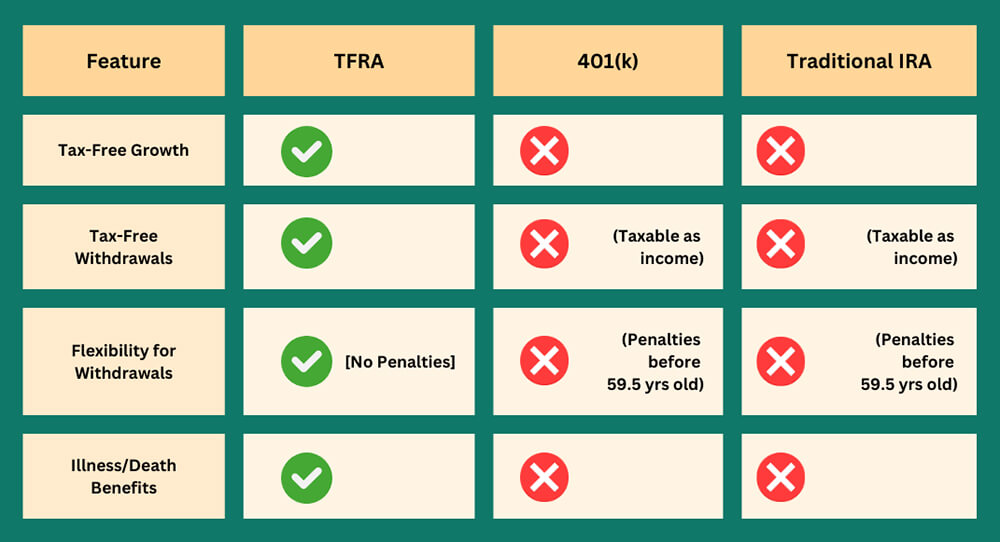

Here’s how a TFRA stacks up against traditional retirement savings tools like 401(k)s and IRAs:

While traditional retirement accounts focus exclusively on saving for retirement, a TFRA offers added flexibility, protection, and tax benefits—making it an excellent choice for those who want more control over their finances.

Who Should Consider a TFRA?

A TFRA isn’t for everyone, but it’s an excellent choice if you:

- Want tax-free growth and withdrawals.

- Need flexibility to access funds before retirement without penalties.

- Value additional protection, such as illness payouts or a death benefit.

- Are looking to diversify your retirement strategy beyond 401(k)s and IRAs.

It’s especially beneficial for individuals who are maxing out contributions to other retirement accounts or are in higher tax brackets and want to minimize taxes on their future income.

Getting Started with a TFRA

If you’re ready to explore the benefits of a TFRA, it’s important to work with a knowledgeable financial professional to ensure it aligns with your goals. At Level Coaching, we specialize in helping individuals like you navigate smart financial decisions, including whether a TFRA fits into your retirement strategy.

Why work with us?

- We’ll help you understand the tax implications and potential growth of your TFRA.

- We’ll guide you in tailoring your TFRA to your unique goals, whether that’s retirement income, a safety net for illness, or major life purchases.

- We’ll ensure you have a comprehensive financial plan that sets you up for long-term success.

Final Thoughts: A TFRA Is More Than a Retirement Account

A Tax-Free Retirement Account isn’t just about preparing for retirement—it’s about creating financial flexibility and peace of mind for your entire life. From tax-free growth and withdrawals to the ability to fund life’s milestones, a TFRA offers benefits that go far beyond traditional retirement tools.

At Level Coaching, we’re here to help you unlock the full potential of your finances. If you’re ready to take control of your future, schedule a free consultation today and let’s discuss how a TFRA can fit into your financial journey.

Your future self will thank you.